getty

Bottom Line: Ramp's $30M funding round announced today reflects the significant results their clients are achieving using the startup's spend management platform to remove expense, spend and vendor management roadblocks, saving thousands of dollars in the process.

Using AI To Help Customers Accumulate More Dollars Not Points

Launched in 2019, Ramp provides an AI-based corporate credit card and spend management platform designed to help businesses break through the bottlenecks that stand in the way of saving more. Founder and CEO Eric Glyman, who sold his previous startup Paribus to Capital One, says that Ramp's idea began when he and the co-founders realized that innovating with software and AI-first could deliver significant savings and money back to businesses. "I think one of the biggest issues in the credit card industry, which is, so many funds go into sponsoring points programs, not into helping automate and help people get more out of each dollar," Eric said. Motivated by Ramp's many potential ways of turning data into savings for customers, the company launched its corporate card and spend management platform in 2019.

Using AI and machine learning to personalize savings strategies for each customer, including how to trim unneeded subscriptions, proved to be a compelling value proposition, all sizes of businesses acted on. Eric observed, "we started getting involved with businesses and saw a bit of a sad rule that the bigger businesses got, the less efficient, the more wasteful they got with their money." Ramp reached $100M in transaction volume faster than any other corporate card, seeing exponential growth in the last few months. The $30M funding round they received today from D1 Capital and Coatue Management brings their total funding to $50M since launch. Ramp's growth and success in attracting venture funding in a challenging economic environment further prove that their business model is prescient and signals the future of fintech, which is using AI and machine learning to deliver more savings to customers.

Bringing Order To Receipt Chaos Using AI

Keeping track of receipts and submitting them with expense reports is the greatest time-waster any corporate cardholder has today. From purchasing software subscriptions, services and supplies to paying contractors, keeping track of receipts to reconcile a corporate card wastes time. For small businesses where people have multiple jobs, tracking receipts can get chaotic.

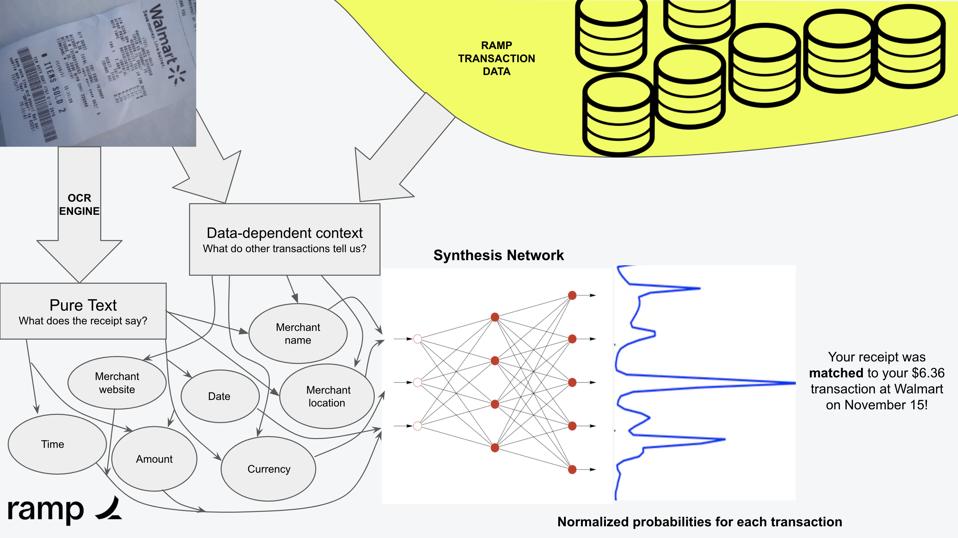

Ramp immediately saw an opportunity to use AI and machine learning to bring order out of the receipt chaos so many businesses routinely go through. Because Ramp relies on the Visa network and Visa Zero Liability Guarantee, they process every transaction and provide clients with the flexibility to define algorithms that approve or deny every purchase. During a recent interview, Eric explained how Ramp automates the most time-consuming aspect of having a corporate card – providing readable, auditable receipts. "Because we're processing the transactions, we can approve or deny each one. We can text or email the cardholder, depending on if it was in person or online. When you still might have a receipt in your hand, you can text a photo of the receipt back and we automatically match that to the right receipt", Eric explained.

Ramp's spend management platform can accept receipts from the electronic channels employees are most comfortable using. For many, that means taking a picture of a receipt and sending it in. Eric continued, "We automate the process behind where customers can email receipts. We auto-match it and can help close the books automatically. I think, at the start, people think about this as this a modern credit card so it must be T&E, but in many of our businesses, it's replaced that PO infrastructure." That alone saves hundreds of hours a month across any business, as anyone who has had to wait for a purchase order to get a service when it could be charged with a corporate card within seconds. The following graphic explains how Ramp combines OCR, data-dependent contextual data and Ramp transaction data to match receipts to charges in real-time with no need for manual intervention. When the pandemic is over, this will make business travel more efficient, leading to more significant cost savings on travel and entertainment expense.

https://ramp.com/

Why AI And Machine Learning Are The Future Of Spend Management

Eric Glyman and the Ramp team prove why AI and machine learning are the future of spend management by how they're using these technologies to tailor personalized spend management strategies for clients in real-time. Early on, the decision was made to create their spend management platform with AI and machine learning designed in from the very start. Eric and the Ramp team early on wanted to take on the challenge of working with an immense amount of data because they knew they’d find new ways to optimize clients’ spend management. “Our early team has members who were formerly part of Facebook AI research and our engineers hail from Google research as well,” Eric explained.

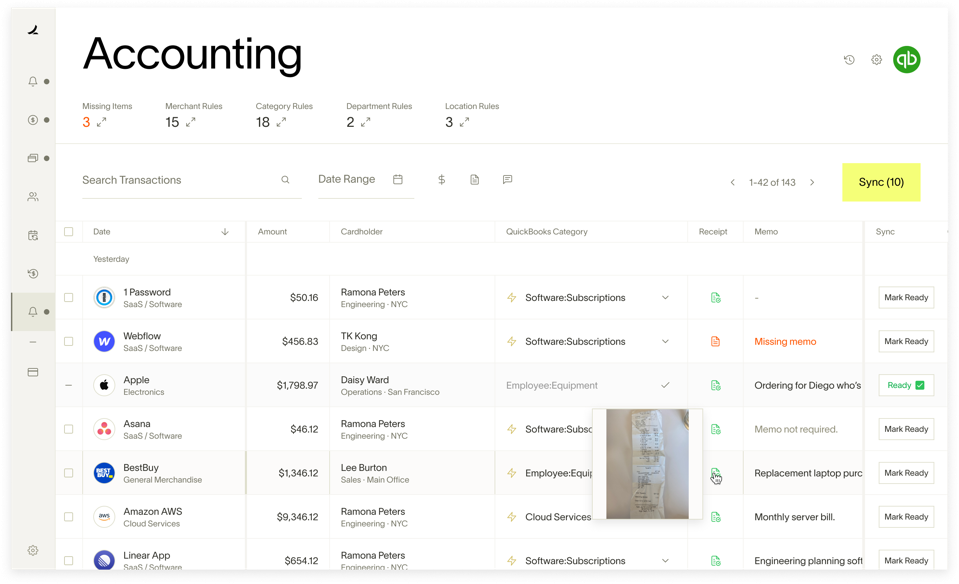

Having designed in AI and machine learning from the very start, Ramp’s spend management platform has the flexibility to tailoring specific workflows to specific customers, matching the nuances of their business. Using machine learning algorithms to learn from and tailor spending policies to each workflow shows accuracy and scale gains because the platform continually looks for and learns what’s best for every client. Eric says that clients can put in rules that further refine the platform's performance for individual workflows. “You can put further rules too, to say, "Look, I, as a business, want to know anytime that someone spends above $100," and you can get alerted. There's a number of safeguards, both in terms of advanced controls that haven't been possible on other cards and workflows, notifications based on activities that businesses can be set,” Eric explained. Ramp is delivering on this vision as their customer satisfaction and G2 ratings show. The following is an example of how intuitive the user interface is to Ramp, while also providing a glimpse of how powerful its AI and machine learning-based workflows are in highlighting transactions that need attention.

https://ramp.com/

Conclusion

Ramp is a fintech startup worth watching because its founders are visionary in relying on machine learning and AI techniques to find new ways to drive more money back to clients. They’ve sidestepped the trap that so many fintech fall into pursuing a point-based value proposition that isn’t going to cut it during economically challenging times. It’s encouraging to see AI and machine learning put to work getting spend management under control, which is precisely what so many businesses need today. Best of all, it alleviates the chaotic nature of keeping track of receipts while giving everyone in a business the chance to contribute and own better financial management and growth.

"save" - Google News

December 18, 2020 at 04:00AM

https://ift.tt/3reKdzp

How Corporate Card Startup Ramp Is Using AI To Save Clients Money - Forbes

"save" - Google News

https://ift.tt/2SvBSrf

https://ift.tt/2zJxCxA

Bagikan Berita Ini

0 Response to "How Corporate Card Startup Ramp Is Using AI To Save Clients Money - Forbes"

Post a Comment