For more than three decades, a majority of Americans have told Gallup that “money and wealth in the U.S. should be more evenly distributed.” Since 1992, the share of U.S. voters who believe “upper-income Americans pay too little in taxes” has dipped below 60 percent only twice (and has never fallen beneath 55 percent in Gallup’s polling). The public’s general sentiments about distributive fairness align with its response to concrete policy proposals: Plans for taxing the wealth of the super rich, and raising top marginal rate to 70 percent, have attracted majority support in recent surveys.

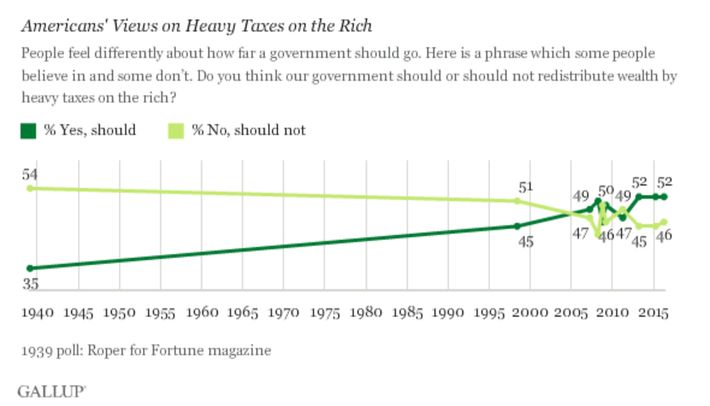

Historically, framing tax-and-spend liberalism in radical terms — by asking voters whether “the government should redistribute wealth by heavy taxes on the rich?” — has attracted majority opposition, even in the heyday of the New Deal. But in the past two decades, that changed.

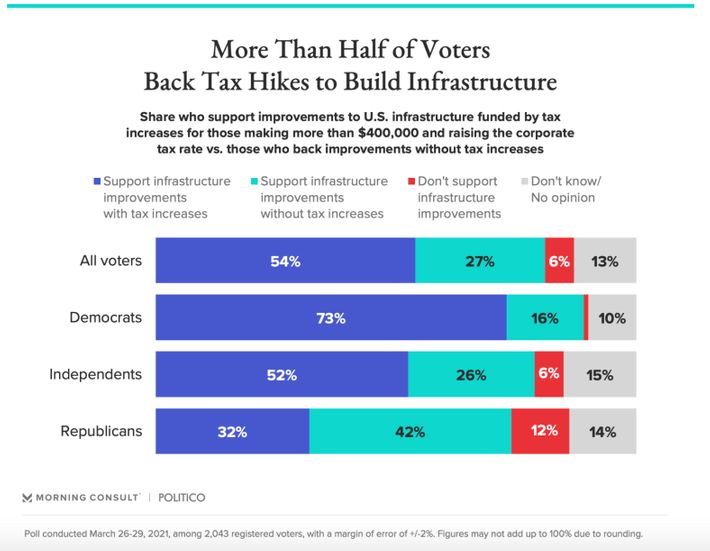

Joe Biden’s specific proposal for tax policy — to take money from the wealthy and corporations and spend it on infrastructure — is overwhelmingly popular. In Morning Consult’s polling, 65 percent of voters endorsed “funding Joe Biden’s $2 trillion infrastructure plan through 15 years of higher taxes on corporations.” Notably, the pollster found that Biden’s proposals for infrastructure spending were much more popular when paired with a corporate tax hike than they were in isolation.

And yet, Politico reported Monday morning that “President Joe Biden and congressional Democrats are taking a big gamble” by pushing for higher taxes on the rich.

And the outlet might be right.

Political popularity and legislative viability are two different things. If Congress’s actions were governed by public opinion, the Trump Tax Cuts would’ve never been enacted. Federal lawmakers aren’t wholly insulated from the popular will. But the percentage of voters who 1) keep track of policy developments on Capitol Hill, 2) strongly favor progressive redistribution, 3) are not already a Democratic partisan, 4) live in a swing district, or state with a competitive Senate race, and 5) will vote for a Republican in 2022 unless Congress raises taxes on the rich is … not large.

By contrast, there are myriad corporate lobbies that closely monitor Congress’s every move, have binders full of research to back up all their preferences and enough money to launch a blitzkrieg of negative ads against any swing-district Democrat who defies their will. What’s more, the demands of the corporate elite and small-business lobbies are buttressed by their deep social ties to many moderate Democratic lawmakers (who typically spend a great deal of time rubbing shoulders with their state or district’s country-club set).

For these reasons, Biden’s tax plan is dividing Congressional Democrats, even as it unites a bipartisan majority of Americans.

In fact, corporate lobbyists believe that they already have the votes to block the president’s proposed changes to individual tax rates, and to weaken his corporate rate hike. As Politico reports:

Interviews with over a dozen executives, lobbyists and business group officials turned up a similar theme: While Democrats might be able to push through a slightly higher top corporate rate, when it comes to higher taxes on the rich, on capital gains, on financial transactions or private equity profits, forget it. It’s not happening…

Lobbyists and executives say they have been talking to moderate Democrats in the Senate like Joe Manchin of West Virginia, Kyrsten Sinema of Arizona and John Hickenlooper of Colorado along with House members like Josh Gottheimer of New Jersey, Tom Suozzi of New York and Stephanie Murphy of Florida. Most of the lawmakers either declined to comment or did not respond to requests for comment. The lobbyists say most of the members they’ve spoken to have indicated a willingness to push back against many of the proposed tax increases in Biden’s plan.

These lobbyists’ avowed confidence might be a PR tactic. But Senator Manchin has already made his doubts about Biden’s proposed corporate and capital-gains tax rates known. And Suozzi and Gottheimer have both pledged to oppose Biden’s entire infrastructure package if it doesn’t include a restoration of the full state-and-local income-tax deduction, a de-facto tax cut for the affluent and one that would greatly increase the bill’s overall cost.

The fundamental problem facing the White House is the thinness of its congressional majorities. It can’t afford to lose a single Democratic vote in the Senate and can’t lose more than two in the House. Earlier this year, several moderates in the Senate — including Manchin — signaled greater comfort with taxing the rich than further increasing the deficit. This, combined with the administration’s own substantive concerns about inequality and inflationary risk, led Biden to fully offset his proposals for new spending with revenue-generating taxes on the top one percent. But now that moderates are faced with what their demands for fiscal probity require — a doubling of the capital-gains tax rate, and various other affronts to the most economically powerful people they know — expanding the deficit may prove more palatable than soaking the rich.

Or at least this is what the lobbyists who spoke with Politico seem to think:

[Corporate executives and lobbyists] think progressive Democrats don’t really care about the costs of new programs and will be happy to push through as much spending as they can and then run on tax hikes in 2022 rather than actually pass them this year.

The notion that House progressives will accept unfunded spending on climate and new social programs — if the alternative is no such spending — is doubtlessly correct. The implication that Kyrsten Sinema and Joe Manchin will accede to this preference is more speculative.

Nevertheless, K Street’s conventional wisdom points to the question that will determine the fate of Biden’s legislative priorities: Is there a version of the “Build Back Better” agenda that is large enough to satisfy progressives, sufficiently “paid for” to appease deficit scolds, and easy enough on the wealthy to satisfy corporate America’s favorite Democrats?

With his American Recovery Plan, Biden solved this tri-lemma by sidelining the scolds. Despite having little to no margin for error, Nancy Pelosi and Chuck Schumer managed to get a $1.9 trillion stimulus through the House and Senate. But at that time, debt-phobic Democrats could rationalize such spending as an emergency measure. To countenance another $4 trillion in largely unfunded outlays would require an embrace of a new fiscal orthodoxy. The doctrines of Modern Monetary Theory (and/or functional finance) have gained some currency on Capitol Hill. But relatively few Democrats have been willing to forthrightly endorse the notion that inflation is the only constraint on public spending in the U.S., or that perpetually high deficits aren’t inherently undesirable. And even if they did accept these (correct) premises, moderates might still object to deficit-financing Biden’s agenda on anti-inflation grounds. After all, last week’s consumer-price-index report has led some in the Democratic firmament to warn of impending, out-of-control price rises.

Nevertheless, something has to give. The White House appears serious about trying to pass a portion of its infrastructure plan with Republican support. But given the GOP’s foundational commitment to increasing the wealthy’s post-tax income, any bipartisan infrastructure bill would have to be deficit-financed. Meanwhile, the Democrats’ thin margins give House progressives as much veto power over the rest of Biden’s agenda as Manchin. Every faction of the party has an interest in avoiding a complete legislative failure that makes their president look weak and ineffectual; the more popular Biden is in November 2022, the better off every swing-district Democrat will be. Yet every faction is also aware of this reality and thus has reason to think it might prevail in a game of chicken with the others. Progressives generally hail from safer districts (and/or states) than moderates do. And this potentially gives them a source of leverage; they have less to lose in personal, electoral terms from a legislative breakdown. Yet progressives are also, typically, more ideologically invested in Biden’s priorities, a fact that moderates can potentially exploit.

How this intra-party staring contest will resolve is the $4 trillion question. But paring back Biden’s proposals on spending would deal an immediate blow to Democratic constituencies, while soaking the rich would directly antagonize Josh Gottheimer’s patrons. Absent a genuine spike in inflation, papering over the coalition’s divisions with new Treasury bonds may be the path of least resistance.

"save" - Google News

May 18, 2021 at 03:00AM

https://ift.tt/3byT60c

If Moderates Kill Biden’s Tax Plan, Will MMT Save His Agenda? - New York Magazine

"save" - Google News

https://ift.tt/2SvBSrf

https://ift.tt/2zJxCxA

Bagikan Berita Ini

0 Response to "If Moderates Kill Biden’s Tax Plan, Will MMT Save His Agenda? - New York Magazine"

Post a Comment